Vadilal Forex Provides services to effectively manage your Exchange Rate Risk and mitigate the effects of Volatility in the Foreign Exchange Market.

Vadilal Forex helps you to prepare, modify and implement the Exchange Rate Policy as well as advise you on the strategies and tactics to safeguard your Financials, effectively Hedge your Foreign Currency Receivables and Payables.

Vadilal Forex has Special service segments to provide Valuation of Options, Swaps, and Structured Derivative Products and qualitative analysis of the same to suit the risk profile of the clients.

Vadilal Forex also provides specialized services for Currency Traders. Forex Service segment website includes Currency Calculator, Forward Calculator, Option Calculator apart from providing LIVE Spot and Forward Rates and indicative rates for Capital and Commodity Markets.

The Services include – Personalized Briefing, Daily Reports, and Special Research Reports.

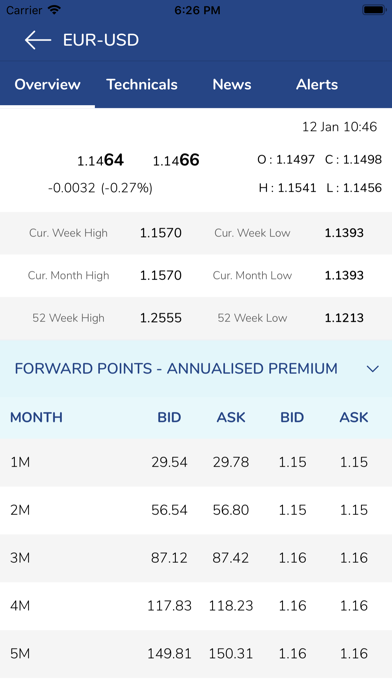

- Live Inter-Bank Foreign Exchange Rates

- Live Monthly and Annualized Forward Point

- Live Forward Calculator for Major currencies

- Daily Research Reports

- Live important News Streaming

- Expert Advice on Forex Hedging Strategies

- Expert Advice on Options and Swap valuations

- Expert Advice on FEMA and RBI related Queries

- Expert Assistance for Forex Risk Management Policy

Vadilal Forex provides Advisory and Exposure Management Services in relation to Base Metals.

Vadilal Forex provides specialized service segments – in case of Base Metals for Corporate having Commodity Risk in relation to Base Metals and Crude Oil, Metal Importers, Scrap Metal Traders, as well as Traders on MCX and LME.

The services under various packages include.

- Ongoing LME Rates updated at regular time intervals

- LME Stock and Settlement Data

- Historical Data

- Personalized briefing

- Daily Morning and Evening Reports

- Special Reports

- Expert Assistance for Forex Risk Management Policy

- Trading Tips

MONEY CHANGING (AD II)

VADILAL is RBI AUTHORISED DEALER Money Changing (AD-II)

Offers Services:

- Buy and Sell all traded currencies and Travellers Cheques and Travellers Cards.

- Remittances for all Current and Capital [restricted] accounts transactions are attended.